Historical Singapore Property Market Returns During Interest Rate Hikes

- Stuart Chng

- Sep 20, 2023

- 4 min read

Written: March 19 2023

It's been a long while since I wrote as I've been soooo busy with so much!

Just to inform my blog readers too, I have moved to Huttons in Sept 2021 with the bulk of NAVIS realtors following us since then.

I am very grateful for the many agents whom have followed us as frankly, I was not expecting much given that changes in environment are always uncomfortable for most people.

Anyway, our migration was a major exercise as more than 1000 agents followed us and there were many obstacles and challenges along the way we had to overcome.

However, it was a necessary and critical move for several long term strategic reasons and I must say, 6 months into Huttons now, the move is a breath of much needed fresh air and we are very happy to have found a near perfect synergy between what NAVIS needed and what Huttons provides.

Historical Singapore Real Estate Market Returns During Interest Rate Hikes

On to our subject proper, with the recent 1st interest rate hike in the US, it is natural that real estate investors, agents and home owners are curious about what that means in the near term for the property market.

Hence, it is apt that we, at NAVIS research (Yours truly), dive deep into the past to take a look at historical periods where similar events has happened.

And these are my findings.

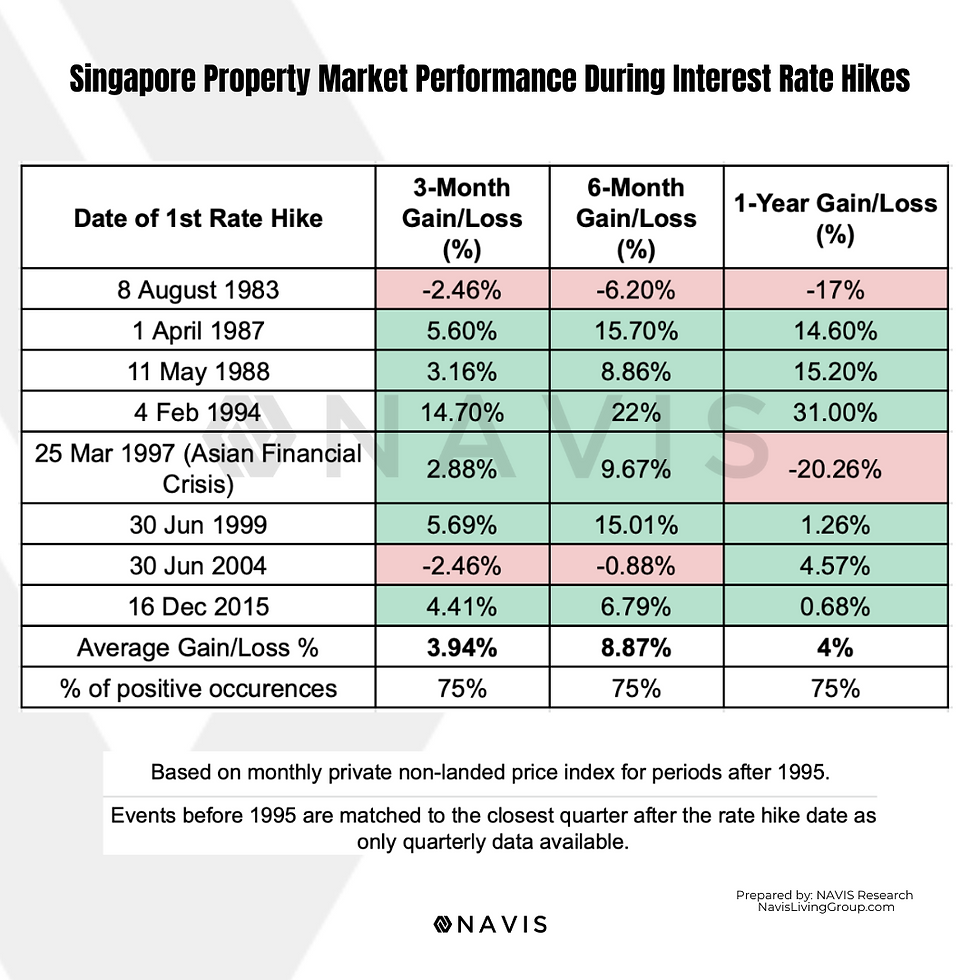

Based on events of a similar nature in the past, we can observe that in the majority of periods measured after the 1st Federal Reserve Rate Hike, the Singapore property market has continued rallying.

To be precise, in all 8 events, 75% of the time the market has rallied in the following 3, 6 and 12 months periods.

At present moment, I do not think it is necessary to project beyond 12 months as global events that come up along the way may further deviate outcomes.

Although the Fed has indicated 6 more potential rate hikes in 2022, it is my opinion is that it may not ultimately happen as we are concurrently facing oil and commodities price spikes in recent months due to COVID and Ukraine-Russia war triggered shortages.

Why?

The lethal cocktail of high interest rates and inflation poses too much of a threat to the finally recovering greater economy. Furthermore, in the most recent major Global Financial Crisis in 2008 which was significantly minor relative to COVID, it took 10 years before interest rates even climbed back to the 2% mark as the economy needed cheaper liquidity for much longer than projected.

Therefore, I maintain the view that low interest rates are here to stay for much longer although it will not be possible for the powers that be to acknowledge this, as it will only fan the flames of discussion for an unpopular issue - high inflation rates.

I believe that the Fed hopes that by pre-empting the market of aggressive further rate hikes, it can cool over-optimistic business spending, market valuations and prevent asset price bubbles from ballooning into the next potential economic disaster.

To summarise, while the past does not necessarily predict the future, historical probabilities still favour a bullish view on the property market as the global economy gets back its footing and "Live With Covid" becomes a way of life.

I am thankful to the many of you who have reached out to me for consultations in the recent months but as my commitments pile up, these days, I am not able to take on all consultations personally.

However, I have many proteges who are equally, if not more, capable of guiding you on property investments if you would like a non-pushy, data driven and higher level insights approach to your upgrading or investment journey.

My team of realtors are trained in the following expertise and will be glad to advise you.

Need an opinion on your property investment plans, the best buys available or help marketing your properties?

Get a 1-time free 30 min Property Wealth Planning consultation with Stuart and his team of Property Wealth Planners. Schedule one right now.

A PWP consultation includes:

- An in-depth financial affordability assessment and timeline planning

- Highly relevant investment insights

- A clear and customised investment road map

- A curated list of best buys in today's market with good growth potential & minimal risks

- Selecting units with the highest potential in a new launch project

- Has your property stagnated in price? What options do you have?

- Marketing plan and getting an optimum offer for your property

Stuart Chng, Executive Group District Director of Huttons Asia, is a renowned leader and personality in the real estate industry.

He adores music and can play a few instruments decently without upsetting his neighbours. When not doing so, he enjoys pillow fighting with his son and coming up with silly puns which barely amuses his wife.

Professionally, he is a licensed real estate agent, an avid stocks, options and real estate investor, multiple businesses owner, team leader, speaker and columnist for several property newsletters and blogs and is often quoted in media interviews on 938FM, Channel 8, PropertyReport, PropertyGuru and other publications.

Throughout his career, he has helped many clients grow their wealth through selecting great property investments and managing their portfolios actively. Read his clients' reviews here.

Stuart has also coached many top million dollar producing agents from top real estate agencies in Singapore. Read his agents' reviews here.

Relevant Articles

Comments